Sales Tax

Sales Tax – Calculated for Service Fees only.

Setup –

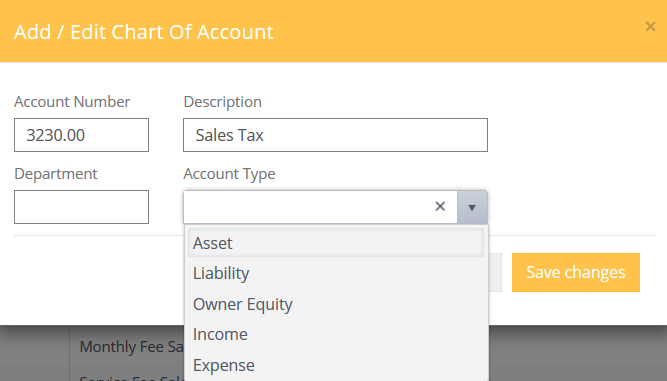

- Click on Accounts Receivable > Chart of Accounts

- Click on

- Add Chart of Account for Sales Tax – be sure to designate Account Type as “Liability.

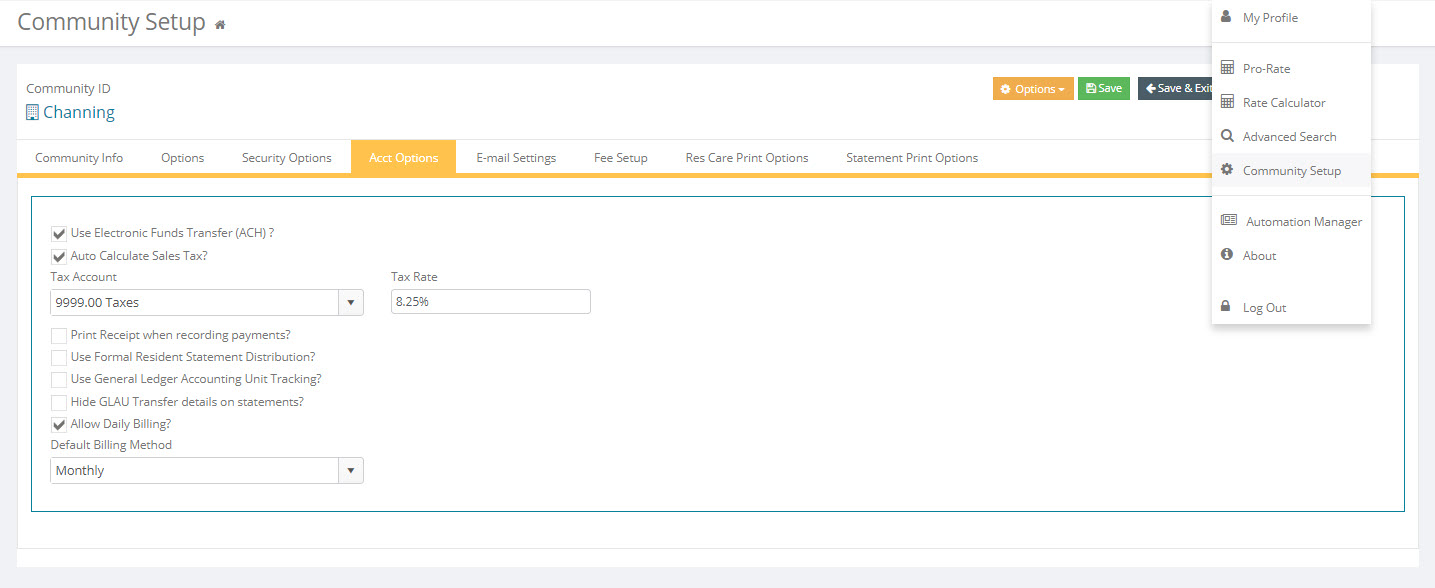

- Select arrow beside name logged in > Community Setup > select Acct Options tab

- Check the box for “Auto Calculate Sales Tax”, select the Sales Tax Chart of Account number from the Tax Account drop down list and enter the Tax Rate percentage. For example: .0825 = 8.25%

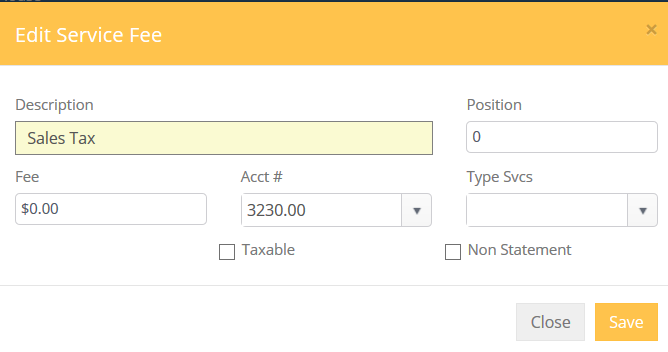

- Service Fee Library – You must have a Sales Tax Service Fee in your Service Fee Library which should be linked to the same GL Account# selected in the Sales Tax section in Community Options.

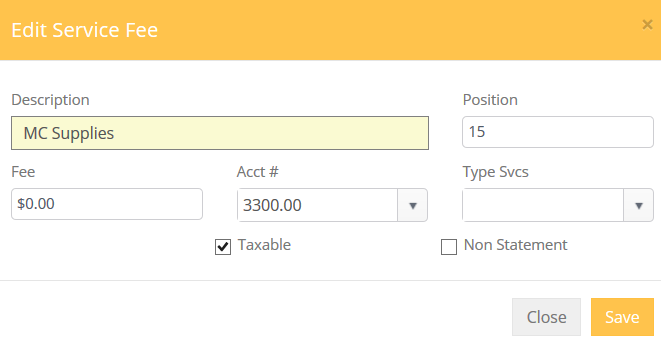

- If you would like a Service Fee to always be taxed, in the Library simply select the “Taxable Item” check box.

- When a Service Fee is entered to a Service Fee that has “Taxable” checked in the library, then it will default to being checked in the Resident Charges screen. You have the ability to uncheck this if you need to.

- The Statement will list each individual Service Fee for the resident and there will be one Service Fee for the total Sales Tax on all applicable Service Fees.