Payments to Non-Statement Items

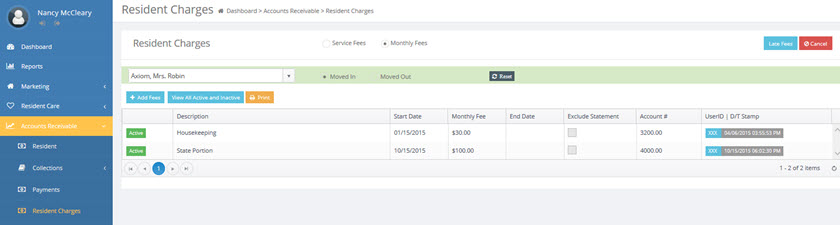

As was discussed in the Monthly Fee setup section, Move-N Accounts Receivable has the ability to track resident charges that will be applied to a third party, such as a third-party charge which should not show up on the Resident's statement. If such charges have been applied to a resident record, they must be paid with a separate payment. Consider the following example;

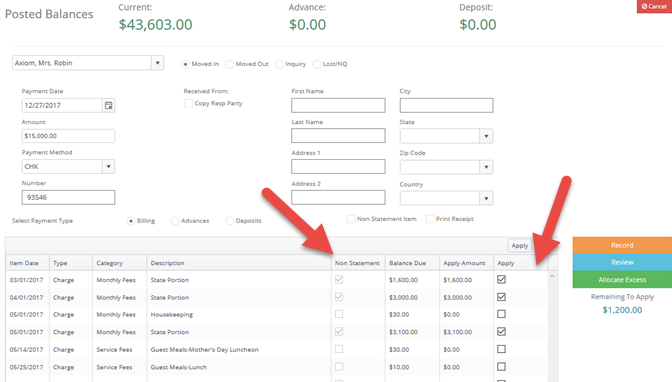

In this example the resident has a monthly fee in the current billing which is indicated as third party items, as noted by the check in the non-statement item column. These items remain outstanding, and may be paid by recording the payment as shown below. Apply the payment to the line items marked "Non Statement" then click "Record".

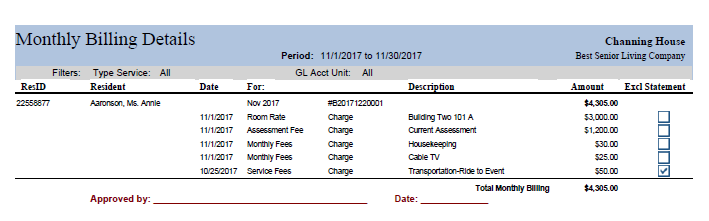

This is a current statement summary showing a non-statement charge.

The primary difference in this and a "normal" payment is that the Non Statement Items checkbox has been checked, indicating that this payment is to apply to non statement items only.

Note: Regular Statement billing items and Non Statements items cannot be mixed and entered on one payment.